Weekly Cape Traffic Tracker – Week 28

Singapore tonnage falls below average as VLOC flows set to rebound

Capesize tonnage passing through Singapore declined sharply last week and fell below the year-to-date average. The fall was driven by a significant drop in Standard Capesize/Newcastlemax volumes, alongside a decrease in dedicated tonnage/VLOCs. Looking ahead, tonnage supply through Singapore is expected to increase this week, led by a recovery in dedicated tonnage/VLOCs.

From a broader perspective, the 3-week rolling average is currently tracking higher YoY, with Standard Capesize/Newcastlemax volumes flat YoY while Dedicated VLOCs are down YoY.

Australian Iron Ore Exports Edge Higher Despite Ongoing Maintenance

Port Walcott and Port Hedland – FMG lead gains while Port Hedland – BHP lags

Australian iron ore exports edged higher last week, supported by stronger shipments from Port Hedland – FMG and Port Walcott, which more than offset the decline in volumes from Port Hedland – BHP. The increase came despite ongoing maintenance at both Port Hedland and Dampier, while further south, Geraldton experienced a more unsettled week, with showers and swells persisting most days.

Looking ahead, maintenance will continue at Port Hedland and Port Walcott, but the northwest is set for fair weather throughout the week—potentially supporting more stable throughput. With benign conditions in the Pilbara and the maintenance schedule largely unchanged, near-term export volumes should continue to stabilise—though southern disruptions may cap gains.

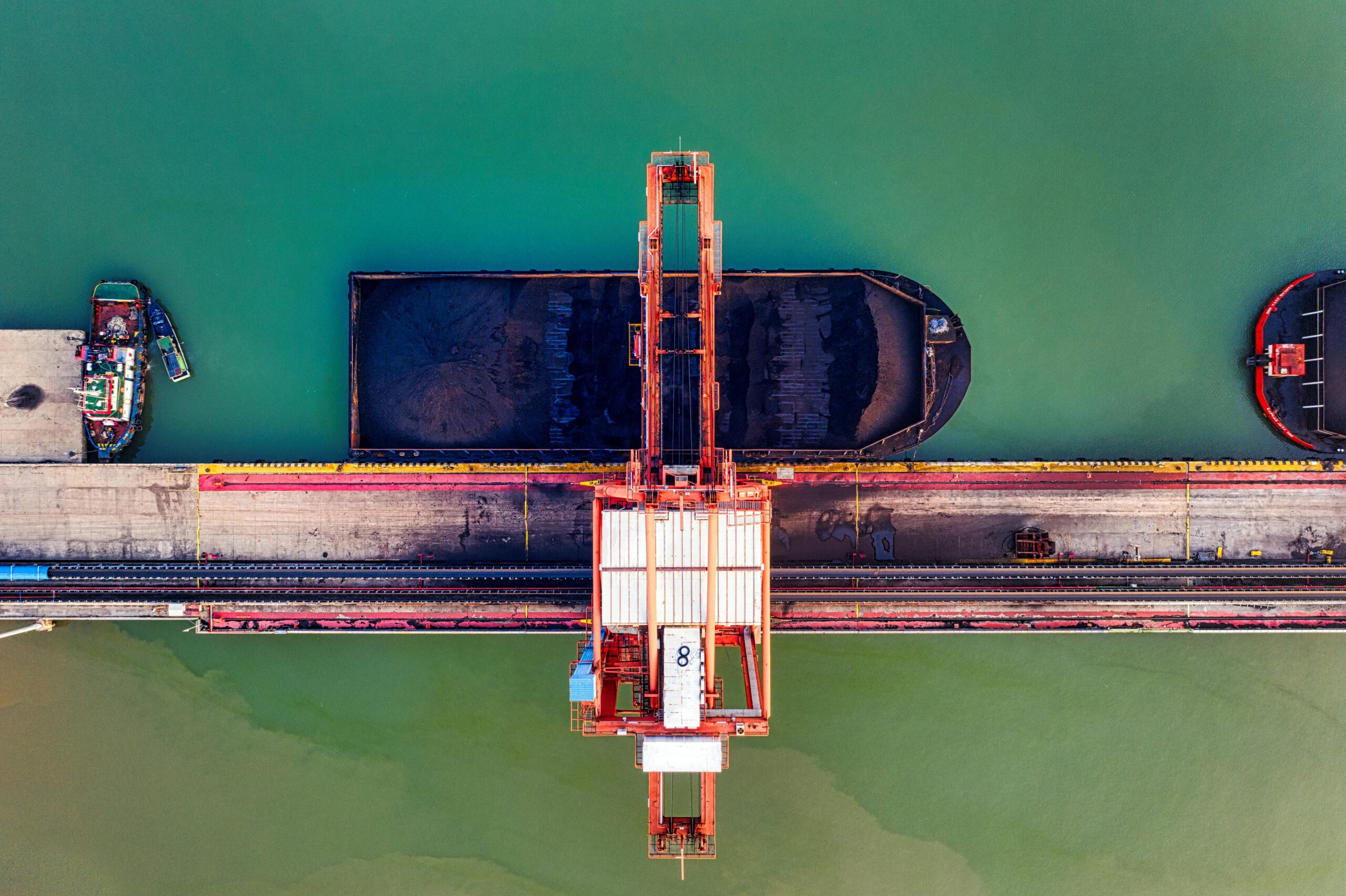

Australian Coal Exports Rebound Strongly Despite Widespread Maintenance

Newcastle, Hay Point, and Gladstone lead recovery across coal grades

Australian coal exports rebounded strongly last week, with both steam and coking coal volumes posting solid gains. The uptick was led by higher steam coal shipments from Newcastle, while coking coal exports rose at Hay Point and Gladstone. Notably, this growth came despite ongoing maintenance at multiple terminals.

Looking ahead, maintenance is set to continue at Abbot Point and Hay Point. With exports rebounding and only limited disruptions forecast this week, momentum may hold in the short term—though persistent wind and rainfall risks remain a wildcard across both Queensland and New South Wales.

Brazil Iron Ore: Weekly Pulse

Exports rebound from prior week, but July lags behind June pace

Brazilian iron ore exports rose last week, recovering from the prior week’s dip as both Vale and the junior miners recorded gains. Vale led the rebound as volumes rose across all tracked ports, while junior miner exports also climbed. CSN, Sudeste (Usiminas + Trafigura), and Anglo American – Minas Rio saw higher volumes, while Ponta Ubu edged lower.

Even with the weekly gain, July’s iron ore shipments are still trending below June and below the same time last year. Vale’s pace is holding steady YoY, but junior miner volumes remain softer both MoM and YoY. Rollover into August is still projected around 8–9 million DWT — well above the 5.6 million DWT rolled over between June and July.